Now Reading: Elon Musk’s Trillionaire Pay Deal Tied to Shareholder Millionaire Goals

-

01

Elon Musk’s Trillionaire Pay Deal Tied to Shareholder Millionaire Goals

Elon Musk’s Trillionaire Pay Deal Tied to Shareholder Millionaire Goals

Quick Summary:

- Tesla is currently valued at over $1 trillion, and Elon musk’s pay package is tied too achieving performance milestones that could elevate its value to $8.5 trillion.

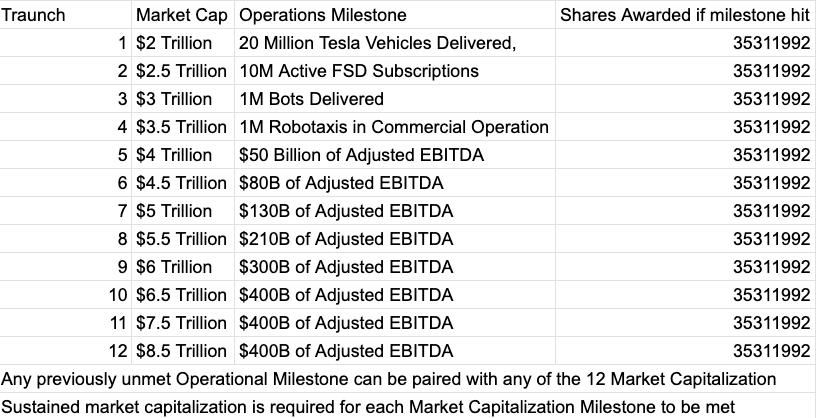

- Musk’s compensation is conditional on reaching 12 stock price milestones, starting with nearly doubling Tesla’s stock price to $619 per share:

– Milestones progress from $619 ($2T valuation) to $2634 ($8.49T valuation).

- Operational goals include delivering 20 million Tesla vehicles, securing 10 million active FSD subscriptions, selling 1 million robots, and deploying 1 million commercial robotaxis.

- Adjusted EBITDA targets range from an initial milestone of $50 billion annually to a staggering quarterly target of $100 billion for final milestones-nearly four times Tesla’s current levels.

- Achieving the adjusted EBITDA would position Tesla far ahead in profitability compared to companies like NVIDIA, microsoft, and saudi Aramco.

Images:

!Stock Milestone Chart

!Adjusted EBITDA Comparison

Indian Opinion Analysis:

Elon Musk’s ambitious pay package signals transformative growth expectations for Tesla based on operational performance and profitability benchmarks unprecedented even among industry giants like NVIDIA or Microsoft. For India-a growing electric vehicle (EV) market-this progress could hold dual relevance: first as a benchmark for local EV innovators aspiring global competitiveness; second as a potential lever influencing Indian manufacturing partnerships or supply chains tied to advanced EV technologies.

Musk’s focus on scaling deliveries (20M vehicles annually), along with robotics and full self-driving capabilities (FSD), showcases priorities beyond conventional car production-a vision mirrored in India’s own push toward autonomous solutions enabled by make-in-India policies.

However, reaching such milestones will likely face constraints including financial scalability amid recessionary concerns globally-a situation prompting careful evaluation from emerging economies like India that might benefit or mirror aspects without similar capital base risks.Read More