Now Reading: Elon Musk Set to Become First Half-Trillionaire with $200 Billion XAI Valuation

-

01

Elon Musk Set to Become First Half-Trillionaire with $200 Billion XAI Valuation

Elon Musk Set to Become First Half-Trillionaire with $200 Billion XAI Valuation

Quick Summary

- Elon Musk’s artificial intelligence company, xAI, is raising $10 billion in funding at a valuation of $200 billion. this follows a previous $5 billion debt raise.

- The new valuation places xAI above Anthropic’s recent valuation of $183 billion and positions it beneath OpenAI’s reported valuations ($300-$500 billion).

- xAI has evolved through several funding rounds since its 2023 inception:

– Nov 2023: Seed round valued at $135M equity.

– May 2024: Series B raised $6B at a post-money valuation of $24B.

– Dec 2024: Series C raised another $6B valuing the company at $50B post-money.

– Mar-July 2025: Merged with X Corp, followed by bridge equity and debt rounds leading to a combined entity value of ~$113B before the current round.

- Post-fundraise dilution will slightly reduce musk’s stake in xAI to approximately 53.6%, valued at $107.2 billion.

- In Musk’s portfolio:

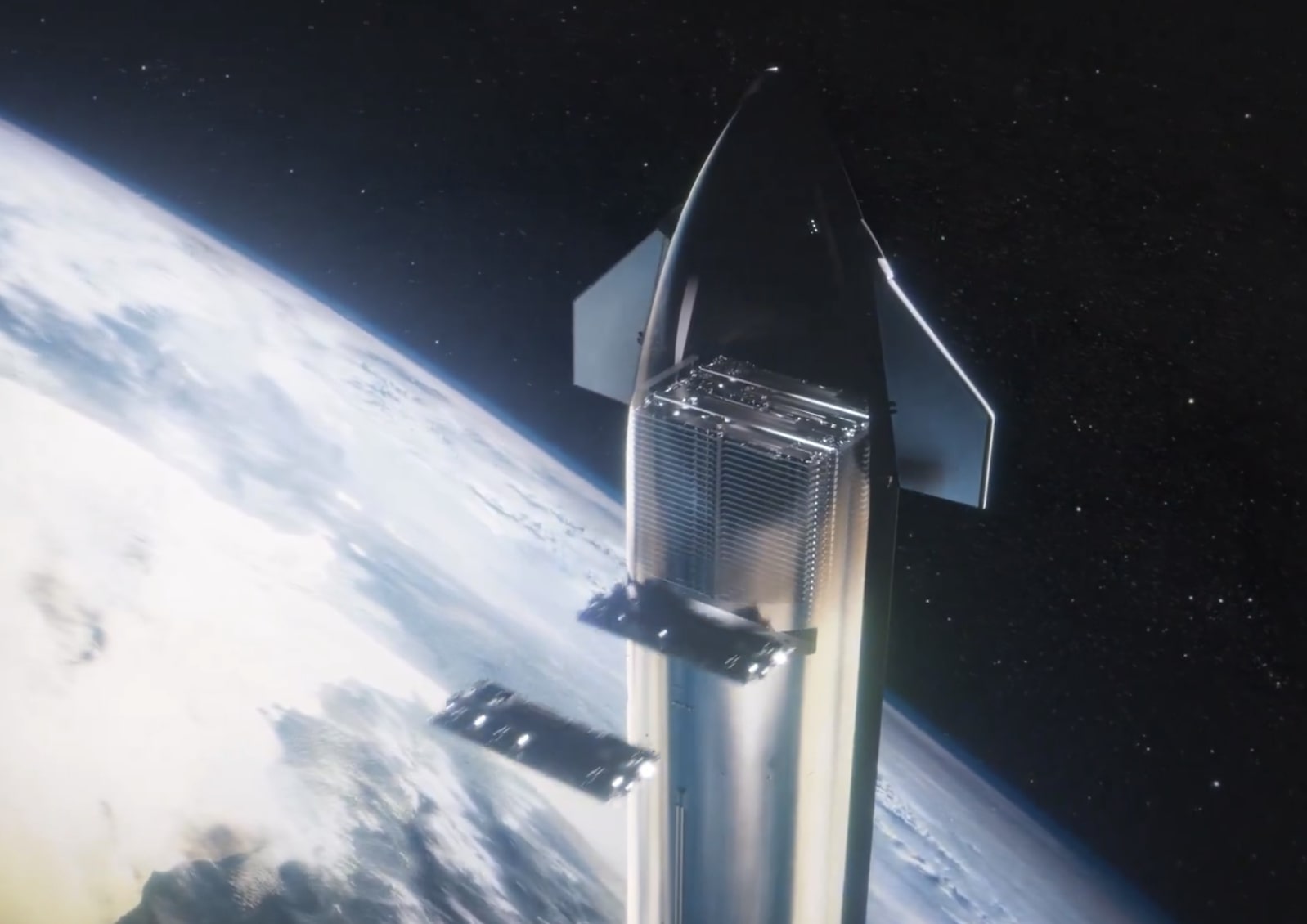

– Tesla is his largest holding (~$175.94 billion based on recent market pricing).- SpaceX values climbed to $408.5 billion after recent investment deals, providing Musk with holdings worth ~$164 billion under current terms.

Indian Opinion Analysis

The rapid growth trajectory of Elon Musk’s companies underscores robust global interest in artificial intelligence and disruptive technologies like those pioneered by xAI. With an increasingly interconnected tech ecosystem (xAI tied to X Corp synergies), this sets new benchmarks for AI firms globally-including India-based competitors like Infosys or TCS diving deeper into generative AI solutions.

Key attention lies on implications regarding funding dynamics; india’s burgeoning startup landscape may face heightened challenges competing for global VC capital against giants building clusters akin to xAI’s Memphis supercomputers or government-linked defense contracts that enhance institutional credibility abroad.

For India, this raises questions about scaling partnerships across domestic AI ecosystems while ensuring indigenization is prioritized despite dependency gaps (e.g., on imported NVIDIA-grade chipsets cited). Navigating such external pressures without losing investment flows toward national interests could remain critical moving forward.Read More