Now Reading: Congress Labels GST Update as ‘1.5’; Calls for ‘True GST 2.0

-

01

Congress Labels GST Update as ‘1.5’; Calls for ‘True GST 2.0

Congress Labels GST Update as ‘1.5’; Calls for ‘True GST 2.0

Speedy Summary

- The GST Council has approved an overhaul of the Goods and Services Tax (GST) system, shifting to a new simplified two-rate structure: 5% and 18%.

- A special 40% slab will apply to select luxury items like high-end cars and tobacco-related products.

- Starting September 22, tax reductions will benefit many personal-use items such as TVs, air conditioners, washing machines, roti/paratha, hair oil, ice cream; life insurance premiums and health insurance policies are exempted from GST.

- Aim: To reduce compliance burdens on MSMEs while boosting domestic spending amidst subdued private investment rates.

- Union Finance Minister Nirmala Sitharaman stated there was unanimous agreement in the GST Council meeting held on September 3.

- Opposition criticism:

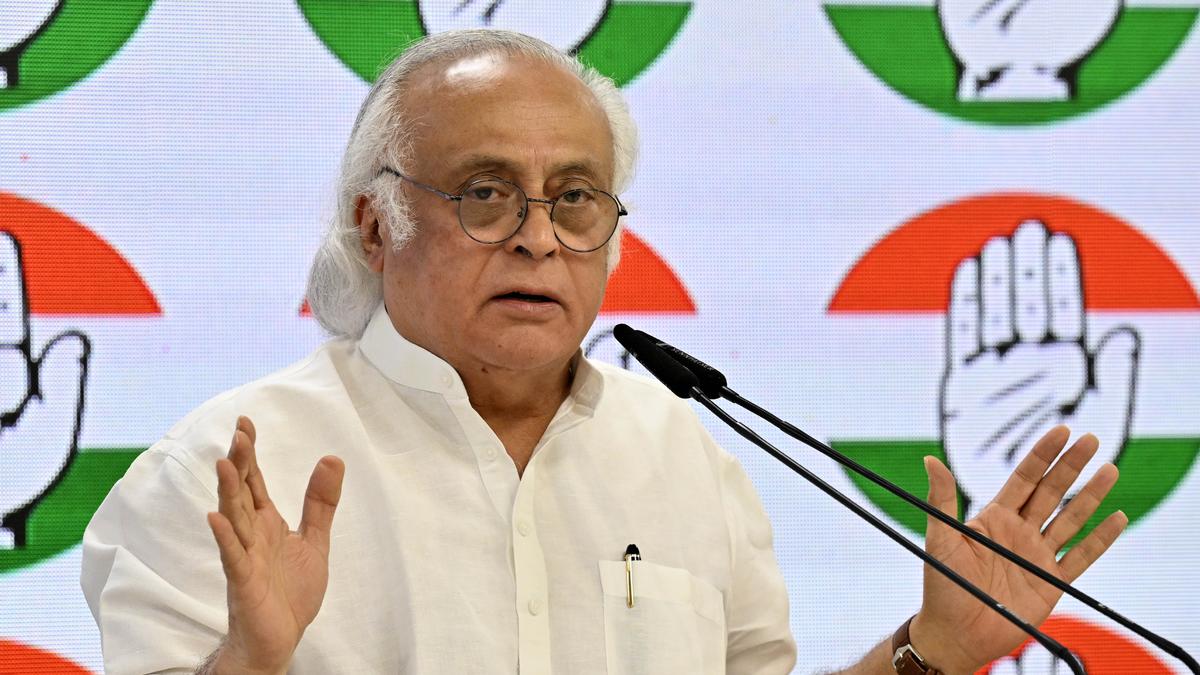

– Congress termed these changes “GST 1.5,” stating it falls short of their proposed “GST 2.0” reforms aimed at simplifying tax slabs and addressing structural flaws such as inverted duty structure.- Congress leader Jairam Ramesh questioned the extent of reformative impact and raised concerns over unaddressed state revenue protections under cooperative federalism.

Indian Opinion Analysis

The simplification of India’s GST regime marks a notable progress aimed at rationalizing consumption taxes across diverse sectors while fostering economic activity during challenging times for private investment. Rate cuts may provide immediate relief to consumers by lowering costs for everyday goods like appliances or food staples. Moreover,eliminating GST on life/health insurance premiums encourages financial inclusion.

Despite these merits, certain aspects remain contentious; opposition critiques highlight unresolved issues such as ongoing classification disputes or inverted duty structures that continue burdening industries dependent on input-output clarity-challenges flagged since GST’s inception in july 2017.

Consensus-driven decisions are promising evidence of cooperative federal functioning within the Center-state dynamic but questions over states’ long-term revenue losses merit further attention to uphold balanced fiscal policies aligning with India’s growth aspirations amid global economic strains.