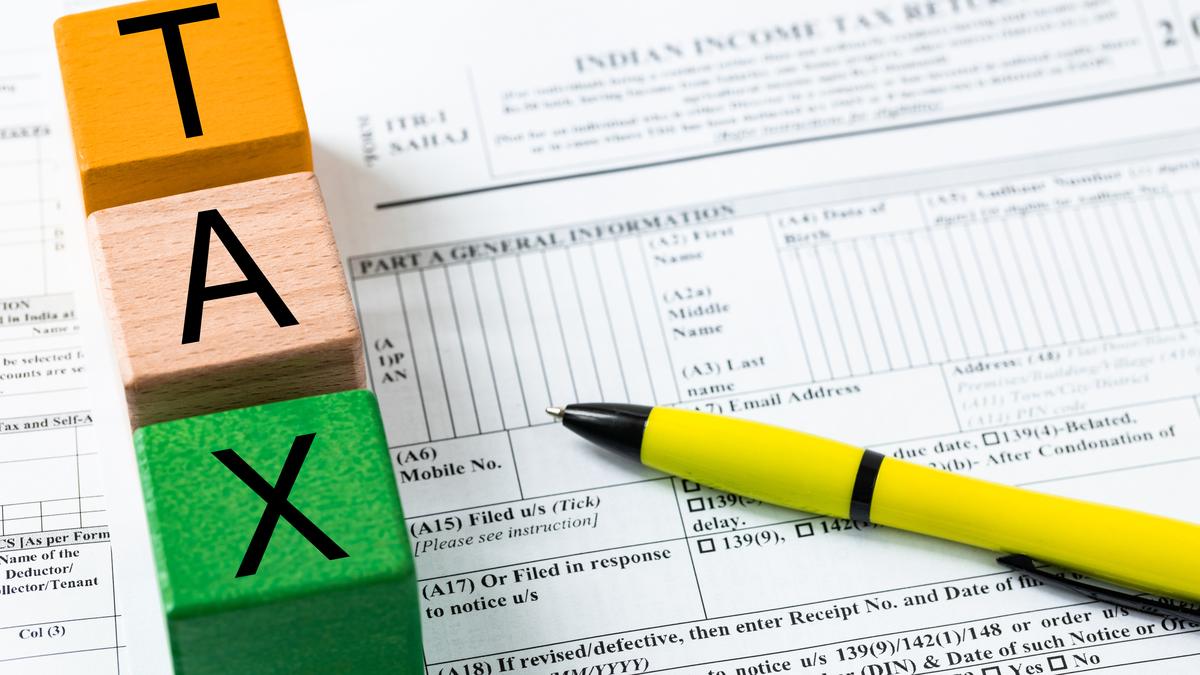

Now Reading: ITR Filing Deadline Ends Today: No Extension Beyond September 15, Confirms Tax Department

-

01

ITR Filing Deadline Ends Today: No Extension Beyond September 15, Confirms Tax Department

ITR Filing Deadline Ends Today: No Extension Beyond September 15, Confirms Tax Department

Speedy Summary

- The Income Tax Department clarified that the deadline for filing Income tax Returns (ITRs) remains September 15, 2025.Claims circulating on social media suggesting an extension to September 30 are false.

- The department issued a statement on X (formerly twitter), advising taxpayers to follow updates only from its verified handle @IncomeTaxIndia.

- A helpdesk is available round-the-clock for assistance with ITR filing, tax payment, and related services via calls, live chats, WebEx sessions, and social media support.

- As of Saturday (September 14), over six crore ITRs had already been filed for Assessment Year 2025-26. Taxpayers have been encouraged to meet the deadline promptly to avoid penalties and interest charges.

Indian Opinion Analysis

The clarification by the Income Tax Department highlights the importance of combating misinformation in matters involving financial obligations like tax compliance. With fake deadlines circulating online, the department’s proactive communication reinforces trust and ensures taxpayers remain informed accurately through verified channels like @IncomeTaxIndia. Over six crore filings show significant compliance but also underline how extensions can result in last-minute rushes-a predictable issue if deadlines where unclear due to misinformation.

the 24×7 helpdesk provision reflects growing efforts toward improved taxpayer support mechanisms in india’s digital era-an encouraging sign of inclusivity amid increasing volumes of returns being filed annually. By urging timely filings before penalties kick in while strengthening data channels against fake news propagation on social media platforms like X, these measures collectively frame an evolving system both digitally accessible and accountability-oriented.

Read more: Link